Откройте для себя жалюзи электронные +7 (499) 638-25-37, которые обеспечат идеальный контроль света и уюта в вашем доме. Большинство моделей…

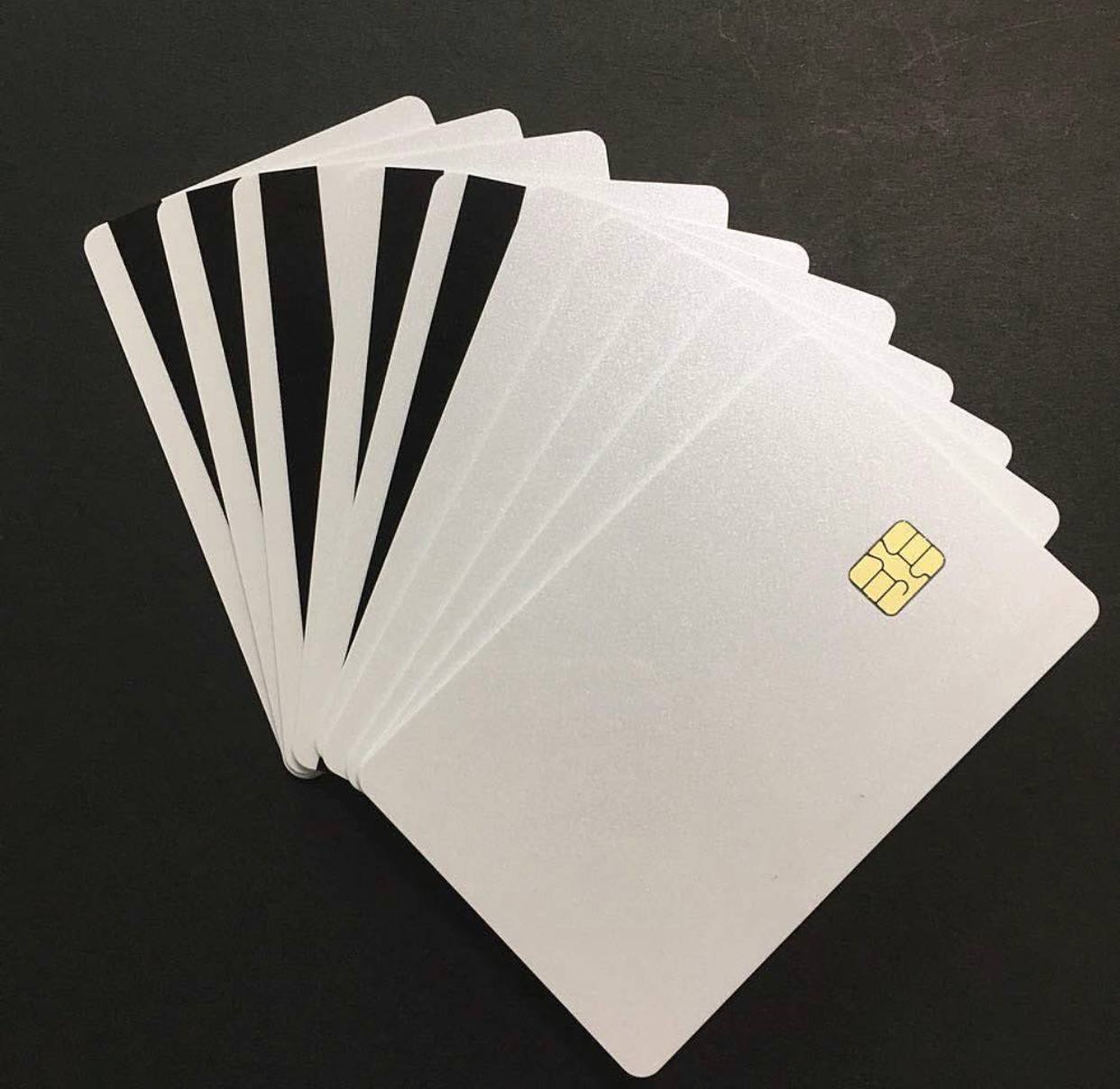

Credit cards for sale

$500.00 – $4,500.00

Credit cards are a popular financial tool that provides convenience and flexibility to users. In this comprehensive guide, we explore the fundamentals of credit cards, including how they work, their features, benefits, and potential risks. We also provide tips for responsible usage, such as paying bills on time, keeping utilization low, and monitoring statements. By understanding credit cards and using them responsibly, individuals can enjoy the perks they offer while maintaining a healthy financial life.

Understanding Credit cards for sale: A Comprehensive Guide

Credit cards for sale have become an indispensable financial tool in today's world. They offer convenience, flexibility, and various benefits to users. However, it's crucial to understand how credit cards work and how to use them responsibly. In this blog post, we'll delve into the fundamentals of credit cards, their features, benefits, potential risks, and tips for responsible usage.

What is a Credit Card?

A credit card is a plastic card issued by a financial institution that allows cardholders to borrow money for purchases. Unlike debit cards, which draw funds directly from a linked bank account, credit cards provide a line of credit that users can repay later.

How Credit Cards Work:

When you make a purchase using a credit card, the issuing bank pays the merchant on your behalf, and you incur a debt to the bank. You are then required to repay the borrowed amount, either in full or in monthly installments, depending on your chosen payment plan.

Credit cards for sale Features:

- Credit Limit: Every credit card has a predetermined credit limit, which represents the maximum amount you can borrow.

- Interest Rates: Credit cards charge interest on any unpaid balance beyond the grace period. It's crucial to understand the interest rates associated with your card.

- Annual Fees: Some credit cards may have an annual fee for the privilege of using them. Make sure to consider this when choosing a card.

- Rewards and Benefits: Many credit cards offer rewards programs, such as cashback, travel points, or discounts on specific purchases. Understanding these benefits can help you maximize your card usage.

Responsible Credit Card Usage:

- Paying on Time: Timely payment of credit card bills is crucial to avoid late fees and interest charges. Set up reminders or automate payments to ensure you never miss a due date.

- Keeping Utilization Low: Aim to keep your credit card utilization (the percentage of your available credit you use) below 30%. High utilization can negatively impact your credit score.

- Regularly Monitoring Statements: Review your credit card statements regularly to identify any unauthorized charges or errors. Report them to your card issuer immediately.

- Avoiding Cash Advances: Cash advances often come with high fees and interest rates. It's best to avoid using your credit card for cash withdrawals.

Building and Maintaining Good Credit:

Using a credit card responsibly can help you build and maintain a positive credit history, which is essential for future financial endeavors. Paying bills on time, keeping balances low, and avoiding excessive debt can contribute to a healthy credit score.

Conclusion:

Credit cards offer convenience and benefits when used responsibly. Understanding their features, fees, and potential risks is crucial to make informed financial decisions. By using credit cards responsibly, you can enjoy the perks they offer while maintaining a healthy financial life.

Additional information

| Amount | $5000, $8000, $10000, $12000, $15000, $20000, $25000, $30000, $35000, $50000 |

|---|

Augustina Seid –

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Lane –

ghrp 6 with ipamorelin dosage

References:

Ipamorelin and Cjc 1295 – gomyneed.com,

Celina Vandell –

Rattling nice style and design and superb content, hardly anything else we want : D.

https://crypto-city.pro/ –

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back down the road. Many thanks

hi88.com –

I’ve learn several good stuff here. Definitely price bookmarking for revisiting. I surprise how much attempt you put to create such a wonderful informative website.

Randal –

supplements and steroids

References:

http://www.google.com.pe

Theda –

cjc 1295 no dac and ipamorelin blend

References:

https://zenwriting.net/chillsharon46/ipamorelin-dosage-calculator-exact-mg-dose-for-your-body-weight

jun888 –

Thanks for one’s marvelous posting! I definitely enjoyed reading it, you happen to be a great author.I will make certain to bookmark your blog and will often come back at some point. I want to encourage yourself to continue your great posts, have a nice weekend!

alegriapg –

It’s laborious to seek out educated people on this matter, but you sound like you realize what you’re speaking about! Thanks

5cc bet –

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

slot resmi –

I don’t commonly comment but I gotta say thanks for the post on this great one : D.

bj88 –

Hi, i think that i saw you visited my weblog thus i came to “return the favor”.I am attempting to find things to enhance my site!I suppose its ok to use a few of your ideas!!

zzzzbet –

Hello. impressive job. I did not imagine this. This is a fantastic story. Thanks!

akongcuan –

Some genuinely great content on this site, appreciate it for contribution. “There is one universal gesture that has one universal message–a smile” by Valerie Sokolosky.

jili slot games –

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on a variety of websites for about a year and am nervous about switching to another platform. I have heard very good things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be greatly appreciated!

Gelatin Trick –

I appreciate, cause I found exactly what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a great day. Bye

bj88 –

Helpful info. Lucky me I found your site unintentionally, and I am stunned why this accident didn’t took place earlier! I bookmarked it.

empire88 login –

I’d need to test with you here. Which isn’t something I usually do! I take pleasure in reading a publish that can make people think. Also, thanks for permitting me to comment!

situs toto –

I’d should verify with you here. Which isn’t something I usually do! I get pleasure from reading a post that may make people think. Additionally, thanks for allowing me to comment!

today 1xbet promo code –

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.