Introduction

The world of finance and commerce is evolving rapidly, with digital payment systems and emerging technologies reshaping the way we transact. As we move towards a more connected and digital society, it is natural to question the future of physical currency, including the beloved dollar bills. In this blog post, we will explore the potential scenarios and implications for the future of dollar bills in an increasingly cashless world.

The Shift Towards Digital Payments

The Rise of Digital Payment Methods

Digital payment options have witnessed a meteoric rise in popularity in recent years. From mobile wallets and contactless cards to online transactions, consumers are increasingly embracing the convenience and speed of digital payments. The ease of use and accessibility of these methods are prompting a shift away from traditional cash-based transactions.

Benefits and Drawbacks of Digital Payments

Digital payments offer numerous benefits, such as instant transactions, enhanced security features, and streamlined record-keeping. Additionally, they eliminate the need for physical currency, reducing the risks associated with cash handling. However, concerns surrounding privacy, data security, and reliance on technology remain valid drawbacks that need to be addressed.

Central Bank Digital Currencies (CBDCs)

Understanding CBDCs

Central Bank Digital Currencies (CBDCs) have emerged as a potential solution to bridge the gap between traditional fiat currency and digital transactions. CBDCs are digital representations of a country’s legal tender, issued and regulated by the central bank. They aim to combine the benefits of digital payments with the stability and security of government-backed currencies.

Central Bank Digital Currencies – Buy Dollar Bills

Implications of a Digital Dollar

In line with global trends, the United States is exploring the possibility of introducing a digital dollar. This move could have far-reaching implications for the future of physical dollar bills. While it offers benefits such as increased financial inclusion and improved transaction efficiency, concerns surrounding privacy, cyber threats, and the impact on traditional banking systems need to be carefully evaluated.

The Role of Physical Cash in the Economy

Importance of Physical Currency

Despite the growing popularity of digital payments, physical cash continues to play a significant role in the economy. It offers anonymity, universal acceptance, and serves as a backup during times of technological or infrastructure failures. Cash remains essential for certain segments of the population, including the unbanked, elderly individuals, and small businesses operating in cash-dependent sectors.

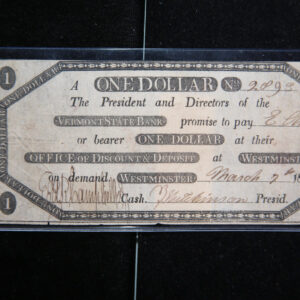

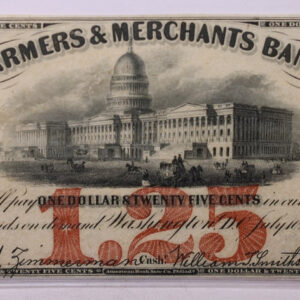

Societal Functions of Dollar Bills

Dollar bills hold cultural and symbolic significance, representing national identity, economic stability, and trust in the monetary system. Additionally, cash transactions contribute to local economies, especially in cash-intensive industries like street vendors, flea markets, and tips-based services. The psychological aspect of physical currency cannot be overlooked, as it provides a tangible sense of wealth and control.

Technological Advancements and Cashless Society

Emerging Technologies Shaping the Future

Advancements in technology, such as blockchain, biometrics, and Internet of Things (IoT), are revolutionizing the financial landscape. These innovations hold the potential to streamline transactions, enhance security, and foster greater financial inclusivity. While they provide promising opportunities for digital payments, their widespread implementation requires addressing scalability, interoperability, and regulatory challenges.

The Vision of a Cashless Society

There is a growing notion of a future without physical cash, where digital payments dominate the financial landscape. A cashless society promises convenience, reduced costs, and enhanced traceability of transactions. However, achieving this vision requires widespread infrastructure development, reliable connectivity

The Vision of a Cashless Society (continued)

and digital literacy among the population. Furthermore, it raises concerns regarding financial exclusion, as individuals who lack access to digital infrastructure or possess limited technological literacy may face challenges in participating fully in a cashless economy.

Government Policies and Regulations

Shaping the Future of Currency

Government policies and regulations play a pivotal role in shaping the future of dollar bills. Authorities need to strike a balance between promoting innovation and safeguarding financial stability and consumer protection. Regulatory frameworks must address issues such as fraud prevention, data security, anti-money laundering measures, and privacy concerns to ensure the successful integration of digital payments while maintaining public trust.

Legal Implications

The transition to digital currency requires a robust legal framework to govern transactions, enforce consumer rights, and address potential risks. Governments must adapt existing laws or create new ones to regulate the use, issuance, and redemption of digital currency. Additionally, legal considerations related to cross-border transactions, taxation, and the role of central banks need careful deliberation.

Societal Acceptance and Cultural Factors

Societal attitudes towards physical cash vary, influenced by cultural norms, generational preferences, and individual perceptions of convenience and security. While some individuals embrace digital payments wholeheartedly, others remain attached to the tangible nature of dollar bills and value the anonymity and freedom they provide. Achieving widespread acceptance of digital payments requires addressing concerns, educating the public, and providing secure and user-friendly platforms.

Trust in Digital Payment Systems

Trust in digital payment systems is crucial for their widespread adoption. Addressing security concerns, implementing robust encryption protocols, and establishing effective dispute resolution mechanisms can bolster trust among consumers and businesses. Collaboration between financial institutions, technology providers, and regulatory bodies is essential to maintain the integrity and security of digital transactions.

Conclusion

As we navigate an increasingly digital world, the future of dollar bills hangs in the balance. While the shift towards digital payments and the exploration of central bank digital currencies offer undeniable benefits, the coexistence of physical cash remains significant. Dollar bills for sale serve various functions in society, from supporting financial inclusion to preserving cultural identity.

The future of dollar bills will be shaped by a multitude of factors, including technological advancements, government policies, societal attitudes, and cultural considerations. Striking the right balance between digital innovation and the preservation of tangible currency will be key to ensuring an inclusive and secure financial ecosystem.

In this ever-evolving landscape, it is essential to carefully evaluate the implications and potential risks associated with the transformation of our monetary systems. Whether we move towards a predominantly cashless society or witness a hybrid model with physical currency alongside digital payments, adaptation, innovation, and thoughtful regulation will be essential for a smooth transition into the future of currency.

References: Real vegas online casino References: https://opensourcebridge.science/wiki/The_Best_PayID_Casinos_in_Australia_2025

1xbet g?ncel giri? 1xbet g?ncel giri? .

References: Illinois casinos References: https://elclasificadomx.com/author/fogspring07/

References: Mobile casino pay by phone bill References: https://escatter11.fullerton.edu/nfs/show_user.php?userid=9553310

1win чат не отвечает www.1win62940.help

References: Best online casino sites References: kirkpatrick-talley-3.thoughtlanes.net

vavada pobierz apk polska vavada pobierz apk polska

References: Cannery casino las vegas References: https://yogaasanas.science/wiki/Play_Sic_Bo_Online_in_Australia_Exciting_Casino_Game_with_Big_Wins

vavada konto vavada konto

References: Riva casino References: https://rentry.co/t2wdftr6

1x giri? 1xbet-yeni-giris-2.com .

vavada strona nie działa mirror vavada2004.help

1xbet g?ncel giri? 1xbet g?ncel giri? .

References: Tropicana casino online References: https://buck-pope-3.federatedjournals.com/live-casinos-in-australia-2026-best-live-dealer-casinos

birxbet 1xbet-yeni-giris-2.com .

1win вывод средств https://www.1win62940.help

References: Mobile casino games References: https://yogaasanas.science/wiki/Best_Online_Casinos_Australia_Top_Aussie_Gambling_Sites_2026

слоты 1win https://www.1win21567.help

References: Hard rock casino hollywood florida References: https://aryba.kg/user/layerpush58/

vavada plinko jak grać vavada plinko jak grać

free tachi casino coupons slots in united kingdom, united statesn online poker machines and how many gambling casinos are in…

Проверенный поставщик подшипников для разных отраслей, ссылка ниже <a href= https://rentry.co/dp72s5tg

1win промокод 1win промокод

Good post. I definitely appreciate this site. Stick with it!

casino amusements united kingdom, olg thousand islands does turning stone casino cash payroll checks and free online gambling united states,…

1win Visa вывод https://www.1win62940.help

1win комиссия mastercard https://www.1win21567.help

References: The star casino sydney References: http://hikvisiondb.webcam/index.php?title=roblessweeney2009

Проживание и восстановление после перелома шейки бедра под контролем специалистов – Ознакомьтесь с деталями <a href= https://app.talkshoe.com/user/rodnoyochag#google_vignette

vavada wypłata blik vavada wypłata blik