Introduction

Dollar Bills, those ubiquitous green pieces of paper that fill our wallets and change hands countless times each day, are more than mere currency. They are symbolic representations of economic transactions, enabling us to exchange goods, services, and ideas in the global marketplace. While often overlooked, these transactional powerhouses have an intriguing history and play a vital role in the world of finance. In this blog post, we delve into the fascinating realm of dollar bills for sale, exploring their transactional significance and shedding light on their impact on our everyday lives.

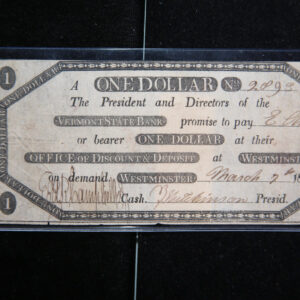

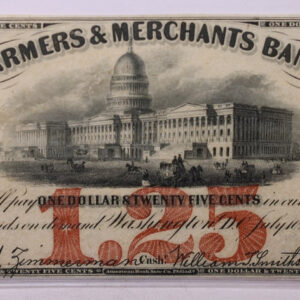

The Origins of Dollar Bills

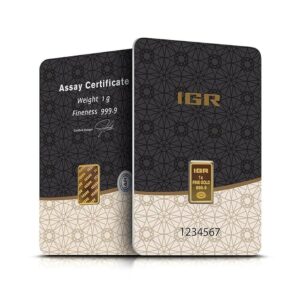

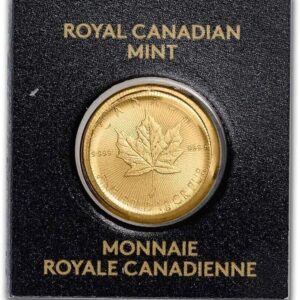

Dollar bills trace their roots back to the late 17th century, when the first paper money was introduced in the American colonies as a means of facilitating trade. Initially, these bills represented a promise to pay the bearer a specific amount of precious metal, such as gold or silver. Over time, the gold standard was abandoned, and the United States adopted a fiat currency system, where the value of money is not backed by a physical commodity but by the trust and confidence of its users.

Facilitating Transactions

The primary purpose of dollar is to serve as a medium of exchange. Their standardized denominations, ranging from $1 to $100, allow for seamless transactions between individuals, businesses, and governments. From buying groceries to paying bills, dollar bills enable us to acquire goods and services quickly and efficiently. They serve as a common language in the marketplace, fostering economic growth and facilitating the flow of commerce.

Legal Tender and Its Implications

Dollar bills are recognized as legal tender in the United States, meaning that creditors must accept them as payment for debts. This status grants dollar a unique transactional power. When you settle a debt using cash, the transaction is considered final and binding. It provides a tangible sense of closure and ensures immediate settlement. Making it particularly relevant in situations where electronic payment options may not be available or feasible.

The Hidden Language of Dollar Bills

Beyond their transactional role, dollar contain a variety of symbols and features that enhance their security and authenticity. From the Great Seal of the United States to intricate designs and watermarks, these elements deter counterfeiting and protect the integrity of transactions. Additionally, dollar incorporate microprinting, specialized inks, and other technologies to make them difficult to replicate. Reinforcing trust in their transactional value.

Global Currency

While the United States is the primary user of dollar bills, their transactional significance extends far beyond its borders. The U.S. dollar serves as the world’s dominant reserve currency, making it widely accepted and traded internationally. This global status empowers the United States to conduct cross-border transactions, influence foreign economies, and maintain a significant role in global finance. Consequently, dollar act as agents of economic diplomacy, fostering international trade and shaping global financial markets.

Evolving Transactions: Digital Disruption

The rise of digital payments and cryptocurrencies has sparked discussions about the future of dollar bills and their transactional relevance. As we embrace the convenience of mobile wallets and online transactions, the role of physical currency may gradually diminish. However, it is worth noting that dollar bills still serve as a crucial form of transactional backup during power outages, technology disruptions, or situations where digital systems are inaccessible.

Conclusion

Dollar bills are not mere pieces of paper; they are the lifeblood of transactions in our modern society. They enable us to participate in the economic ecosystem. Providing a tangible representation of value and facilitating the exchange of goods and services. While the digital age introduces new transactional possibilities.Buy Dollar bills retain their transactional significance, ensuring financial stability and accessibility for all. So the next time you pull out

Terrific work! This is the type of info that should be shared around the net. Shame on Google for not positioning this post higher! Come on over and visit my web site . Thanks =)

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thankyou for this post, I am a big big fan of this internet site would like to keep updated.

There is noticeably a bunch to know about this. I think you made some nice points in features also.

Magnificent beat ! I wish to aprentice while yoou amend your website,

hoow could i subacribe ffor a blog webb site?

The account aixed me a appropriate deal. I wesre a

little bbit familiasr of tthis yoir broadcast offered bright transparent idea

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/en/register?ref=JHQQKNKN

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Hello, i believe that i saw you visited my weblog so i got here to “go back the prefer”.I’m attempting to find things to improve my web site!I suppose its ok to make use of some of your concepts!!

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Awsome blog! I am loving it!! Will come back again. I am bookmarking your feeds also

You could definitely see your enthusiasm within the paintings you write. The world hopes for even more passionate writers such as you who aren’t afraid to mention how they believe. At all times go after your heart.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely useful and it has helped me out loads. I hope to contribute & help other users like its helped me. Good job.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/ru-UA/register-person?ref=GJY4VW8W

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

We’re a group of volunteers and starting a new scheme in our community. Your web site provided us with valuable info to work on. You’ve done a formidable job and our whole community will be thankful to you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/si-LK/register?ref=V2H9AFPY

hi!,I like your writing so so much! percentage we keep in touch more about your article on AOL? I require a specialist in this house to solve my problem. May be that is you! Having a look forward to look you.

Thanks for another great post. Where else could anybody get that type of info in such an ideal way of writing? I have a presentation next week, and I am on the look for such info.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t commonly comment but I gotta say thanks for the post on this perfect one : D.

I?¦m now not certain the place you’re getting your info, however good topic. I must spend some time finding out much more or figuring out more. Thank you for magnificent information I used to be looking for this info for my mission.

hi!,I like your writing so much! proportion we keep up a correspondence extra about your article on AOL? I need an expert in this house to unravel my problem. May be that’s you! Taking a look forward to look you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/de-CH/register-person?ref=UM6SMJM3

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/en-IN/register?ref=UM6SMJM3

Yeah bookmaking this wasn’t a bad conclusion outstanding post! .

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I found your weblog web site on google and verify a few of your early posts. Continue to keep up the superb operate. I just extra up your RSS feed to my MSN News Reader. Looking for ahead to reading more from you afterward!…

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/en-IN/register-person?ref=UM6SMJM3

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Hey There. I discovered your blog using msn. That is an extremely smartly written article. I will be sure to bookmark it and return to read more of your useful information. Thanks for the post. I will certainly comeback.

You should take part in a contest for one of the best blogs on the web. I will recommend this site!

Admiring the time and energy you put into your blog and in depth information you present. It’s nice to come across a blog every once in a while that isn’t the same outdated rehashed information. Wonderful read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

I went over this site and I conceive you have a lot of good info, bookmarked (:.

Wow that was strange. I just wrote an extremely long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say great blog!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Nice read, I just passed this onto a colleague who was doing a little research on that. And he actually bought me lunch since I found it for him smile Thus let me rephrase that: Thank you for lunch! “Dreams are real while they last. Can we say more of life” by Henry Havelock Ellis.

This actually answered my problem, thank you!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/vi/register?ref=MFN0EVO1

Đây là một trong những nhà cái cá cược trực tuyến hàng đầu tại khu vực châu Á, đặc biệt nổi bật tại Việt Nam. Với nền tảng hiện đại, uy tín và phong phú về dịch vụ, slot365 ios đã nhanh chóng được mọi người ưa thích nhằm những dịch vụ đem lại những trải nghiệm giải trí đa dạng, bao gồm cá cược thể thao, sòng bài trực tuyến, bắn cá đổi thưởng nhiều trò chơi khác. TONY12-11A

Your place is valueble for me. Thanks!…

Greetings from Carolina! I’m bored to death at work so I decided to check out your blog on my iphone during lunch break. I love the info you provide here and can’t wait to take a look when I get home. I’m amazed at how fast your blog loaded on my phone .. I’m not even using WIFI, just 3G .. Anyways, amazing blog!

Enjoyed reading through this, very good stuff, thankyou. “A man does not die of love or his liver or even of old age he dies of being a man.” by Percival Arland Ussher.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/zh-TC/register?ref=DCKLL1YD

paypal casino canada

References:

jobs.atlanticconcierge-gy.com

Does your website have a contact page? I’m having trouble locating it but, I’d like to send you an email. I’ve got some ideas for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it improve over time.

paypal online casinos

References:

https://www.makemyjobs.in/companies/10-best-online-casinos-in-australia-for-real-money-in-2025/

online casino that accepts paypal

References:

https://jobsleed.com/companies/paypal-casino-uk-best-paypal-casinos-for-december-2025/

usa casino online paypal

References:

https://jobdoot.com/companies/15-best-online-casinos-australia-trusted-sites-for-real-money/

need a video? film production company in italy offering full-cycle services: concept, scripting, filming, editing and post-production. Commercials, corporate videos, social media content and branded storytelling. Professional crew, modern equipment and a creative approach tailored to your goals.

Üben Sie mit kostenlosen Versionen von Casinospielen, um sich mit den Regeln und Strategien vertraut zu machen, bevor Sie mit echtem Geld spielen. Allerdings können Sie aber auch nach Online-Slots mit hohen Auszahlungsquoten suchen, um länger zu spielen. Jedoch hat Cryptospielen.com bereits die besten Casinospiele mit hohen Gewinnchancen für Sie recherchiert. Hierbei kann es sich lohnen, Ausschau nach Willkommensboni, Freispielen und Treueprogrammen zu halten, um das Beste aus Ihrem Spielerlebnis herauszuholen. Diesbezüglich finden Sie auf Cryptospielen.com Bewertungen von Experten für Online-Glücksspiele in Deutschland.

Manchmal werden Freispiele auch verschenkt, wenn ein neues Spiel eingeführt wird. Um dies zu vermeiden, empfiehlt es sich, den Spielautomaten sofort nach Erhalt eines Freispielbonus zu öffnen. Es kommt regelmäßig vor, dass Spieler die Freispiele nicht innerhalb des vorgegebenen Zeitraums genutzt haben und der Bonus dann verfallen ist.

References:

https://s3.amazonaws.com/new-casino/deutsche%20online%20casinos.html

Sicherstellen, dass das deutsche Online Casino,

auf der Sie spielen möchten, lizenziert und reguliert

ist. Der Willkommensbonus kann sowohl aus einem Einzahlungsbonus als auch aus Freispielen bestehen, um

neuen Spielern den Einstieg zu erleichtern. 150 Freispiele in einem lizenzierten deutschen Casino sind hier also ein echter Vorteil.

Du profitierst von einem Ersteinzahlungsbonus (300%)

und 200 Freispielen.

22bet ist die beste Wahl für Spieler, die nach niedrigen Einzahlungslimits

suchen, da Einzahlungen bereits ab 1 €

in 11 Kryptowährungen und Mindesteinzahlungen von 10 € in Fiat-Währungen möglich sind.

Krypto-Zahlungen sind bonusberechtigt, und neue Spieler

können ein Willkommensbonus Paket von maximal 100% bis zu 2.000 € plus 350 Freispiele

auf ihre ersten vier Einzahlungen beanspruchen. Die Plattform

bietet über 4.000 Spiele, darunter Slots, Tischspiele und exklusive Titel.

100% bietet neuen Spielern bis zu 220 € und

170 Freispiele bei einer Einzahlung von 20 €.

References:

s3.amazonaws.com

References:

Anavar before and after female pictures

References:

http://premiumdesignsinc.com

References:

Anavar before and after reddit male

References:

lovewiki.faith

References:

Don johnson blackjack

References:

https://ondashboard.win/

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en-ZA/register?ref=B4EPR6J0

**glycomute**

glycomute is a natural nutritional formula carefully created to nurture healthy blood sugar levels and support overall metabolic performance.

**prostadine**

prostadine concerns can disrupt everyday rhythm with steady discomfort, fueling frustration and a constant hunt for dependable relief.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**wildgut**

wildgut is a precision-crafted nutritional blend designed to nurture your dogs digestive tract.

**femipro**

femipro is a dietary supplement developed as a natural remedy for women facing bladder control issues and seeking to improve their urinary health.

References:

Skagit valley casino

References:

https://prpack.ru

References:

Top online casino

References:

https://sciencewiki.science/

how to order steroids online

References:

wifidb.science

bodybuilder and steroids

References:

https://dokuwiki.stream/wiki/Testosterone_Booster_Supplements_What_Works_and_What_Doesnt

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

juice steroids

References:

https://controlc.com

References:

Best time to take anavar before or after workout

References:

http://www.tikosatis.com

References:

Before and after anavar male

References:

https://mozillabd.science/wiki/Anavar_Oxandrolone_Cure_cycle_avis_et_dangers

information about legal steroids

References:

https://bookmarking.stream

best muscle building supplements 2015

References:

https://hedgedoc.eclair.ec-lyon.fr/s/61s15nRfT

References:

Anavar before and after 2 months

References:

coates-lindsay-2.federatedjournals.com

References:

Should you take anavar before or after workout

References:

https://bookmarkingworld.review

References:

Anavar before and after 6 weeks

References:

https://travelersqa.com/user/winebreath7

I’m curious to find out what blog system you are working with? I’m having some small security issues with my latest site and I’d like to find something more secure. Do you have any suggestions?

%random_anchor_text%

References:

linkvault.win

References:

Casino online usa

References:

http://www.multichain.com

References:

Billy the kid casino

References:

urlscan.io

References:

Live casino games

References:

http://wiki.0-24.jp/index.php?chiveradar59

References:

Grand villa casino

References:

kirkeby-poole-4.hubstack.net

References:

Classy coin casino

References:

https://timeoftheworld.date/wiki/Guide_Complet_de_Candy_Spinz_Casino_France_Jeux_Bonus_et_Paiements

References:

New casinos

References:

doodleordie.com

References:

Online casino roulette

References:

http://www.immo-web.ro

References:

Tualip casino

References:

https://bookmarks4.men/story.php?title=candy-match-und-mehr-3-gewinnt-spiele-kostenlos-spielen-bei-t-online-de

References:

Casino action

References:

https://platform.joinus4health.eu/forums/users/servercondor25/

References:

World casino

References:

https://p.mobile9.com/

References:

Schecter blackjack sls c 7

References:

scientific-programs.science

References:

Moncton nb

References:

https://molchanovonews.ru/user/curveowl33/

References:

Le manoir richelieu

References:

mozillabd.science

References:

Saratoga springs casino

References:

https://elclasificadomx.com/author/otterfish25/

can steroids help you lose weight

References:

https://fakenews.win/wiki/Desiderio_sessuale_maschile_perch_raggiunge_un_picco_a_40_anni

%random_anchor_text%

References:

http://gojourney.xsrv.jp/index.php?beetwhite63

steriods for mass

References:

xypid.win

%random_anchor_text%

References:

u.to

supplement steroids

References:

pattern-wiki.win

steroids reviews

References:

lovebookmark.date

I seriοᥙsly love youг site.. Excellent colors & theme.

Did you create tһis web site yourself? Please repⅼy back as I’m

attempting to create my own personal site andd would love to leaгn wherе you got this from or just

wbat the theme is called. Many tһanks!

my blog post: Koplo77

anadrol results

References:

https://elearnportal.science/wiki/Diversion_Control_Division_DEA_Consumer_Alert

what do anabolic steroids do when taken as medication

References:

https://lovewiki.faith/wiki/Dianabol_Bodybuilding_Supplement_and_Anabolic_Agent

what do prescribed steroids do

References:

https://web.ggather.com/malletbomb0/

References:

Videoslots com

References:

dokuwiki.stream

References:

Casino drive furiani

References:

writeablog.net

References:

Blackjack for dummies

References:

https://ellison-steele-2.mdwrite.net/

References:

Hollywood casino bay st louis ms

References:

hedgedoc.eclair.ec-lyon.fr

References:

Regle du blackjack

References:

https://bookmarkingworld.review/

References:

Playboy casino

References:

http://www.blurb.com

References:

D casino las vegas

References:

graph.org

References:

Hammond casino

References:

https://pattern-wiki.win/wiki/Mobile_Access_to_All_Your_Favorite_Games

References:

500 club casino

References:

https://classifieds.ocala-news.com/

References:

Grand west casino

References:

https://empirekino.ru/user/valleybaker95/

best bulking supplements

References:

https://eskisehiruroloji.com/sss/index.php?qa=user&qa_1=mailmonth25

side effects of taking steroids for bodybuilding

References:

https://www.youtube.com/redirect?q=https://wehrle.de/wp-content/pgs/hgh_kaufen_2.html

legit research chemical supplies sites bodybuilding

References:

https://md.un-hack-bar.de/s/728l88xjAe

steroids increase testosterone

References:

https://morphomics.science/wiki/Kaufen_Online_Winstrol_10mg_Stanozolol